mobile county al sales tax registration

Any tax liens remaining unsold after the auction or sale shall be included in future tax lien auctions or sales until they are sold. Information Motor Vehicle Handicap Tags Dealer Tags Renewal Chart Specialty and Personalized Tags.

Daily Devotional Devotions Math Equations

A bill of sale to the buyer is required on vehicle sales by and individual seller.

. Continue to Full Website. HOURS OF OPERATION. Madison County Service Center 1918 North Memorial Parkway Huntsville AL 35801.

If you need to report a crime or ask a police related question please call the Larimer County Sheriffs Office at 970-416-1985. Register a Vehicle Purchased From an Alabama Dealership. Orange County Tax Collector.

If recorded in Baldwin County you may order certified copies of your Marriage License if married prior to 82919 or Marriage Certificate if married onafter 82919 from the Baldwin County Probate Office in Bay Minette. Open in New Tab Close Window. Madison County Service Center 1918 North Memorial Parkway Huntsville AL 35801.

1-855-638-7092For tax information and assistance contact the Department of Revenue. Monday Tuesday Thursday Friday 700am. Find tax deed sales information search official records and find deeds and other recorded documents.

Sales. A licensed dealer must provide a bill of sale with detail reporting of the amounts and rates of sales tax collected. 830 AM - 500 PM 256 532-3300 256 489-8000.

The Treasurer does NOT determine the amount of tax to be collected. Look Up Code Enforcement Cases and Liens. Madison County Courthouse 100 North Side Square Huntsville AL 35801.

Per 40-2A-15h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self-administered county or municipality may call ALTIST Certified Auditors Complaint Hotline. 830 AM - 500 PM. Orlando Farmers Market Mobile COVID-19 Vaccine Site.

Madison County Courthouse 100 North Side Square Huntsville AL 35801. 830 AM - 500 PM 256 532-3300 256 489-8000. Explore your local licensing authority requirements by clicking on your county in the list below.

Sales Tax Alabama law states that purchasers must pay casual sales taxes on the net purchase price of an acquired vehicle new or used vehicle. Tax Type Authority Sales Tax Title 40 Chapter 23 Article 1 Use Tax Title 40 Chapter 23 Article 2 Simplified Sellers Use Tax Title 40 Chapter 23 Article 6 Div 3 Part 2 Leasing Tax Title 40. Current year tax.

Mobile County License Commission Main Office 3925-F. The fee is 300 per copy and you may request a copy through the mail if you send the fee money order or cashiers. HOURS OF OPERATION.

The 2013 Act amends Section 40-9-21 and provides a total exemption from ad valorem taxes on the principal residence and 160 acres adjacent thereto of any resident of this state who is 65 years. Ive been to the Mobile Tax Commissioners office EIGHT TIMES. Online Filing Using ONE SPOT-MAT.

If your uploaded document or picture doesnt. The County will process your registration and calculate how much you owe in registration fees and taxes. Mobile County License Commission.

It was so very nice to be able to complete the registration online. Assessing Department Revenue Commission Calhoun County Alabama. The County Treasurer is responsible for mailing Property Tax Statements to the owner of record collecting property taxes and disbursing taxes to the taxing authorities school districts citiestowns the county special districts etc.

Mobile County License Commission Main Office. We recommend calling us at 251-574-8530 ahead of time and making an appointment. Review the laws on the Alabama Legislatures web site.

830 AM - 500 PM. The bill eliminated the authority of municipalities to levy a business license tax and consequently existing business licenses in NC no longer needed to be renewed. Online Filing Using ONE SPOT-MAT.

If you have an emergency please call 911. 1-334-844-4706 Toll Free. Home Assessor Property Search.

Act 48 Section 40-9-21- Complete Exemption for those Disabled or over 65. You can further drill down to your city to better understand all of your. HOURS OF OPERATION.

For more information on the value of your property or the amount of the. County and City sales taxes collected by the seller. HOURS OF OPERATION.

Us Ecommerce Grows 6 7 In Q1 2022

Crypto Scams Are The Top Threat To Investors By Far Say Regulators

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

We Re Having A Free For All At Lagniappe Home Store We Have A Huge Selection Of Brand Name Furniture Mattresses And Home Accents At The Best Prices In Town A

How To Become A Loan Signing Agent In Missouri Loan Signing Agent Loan Signing Notary

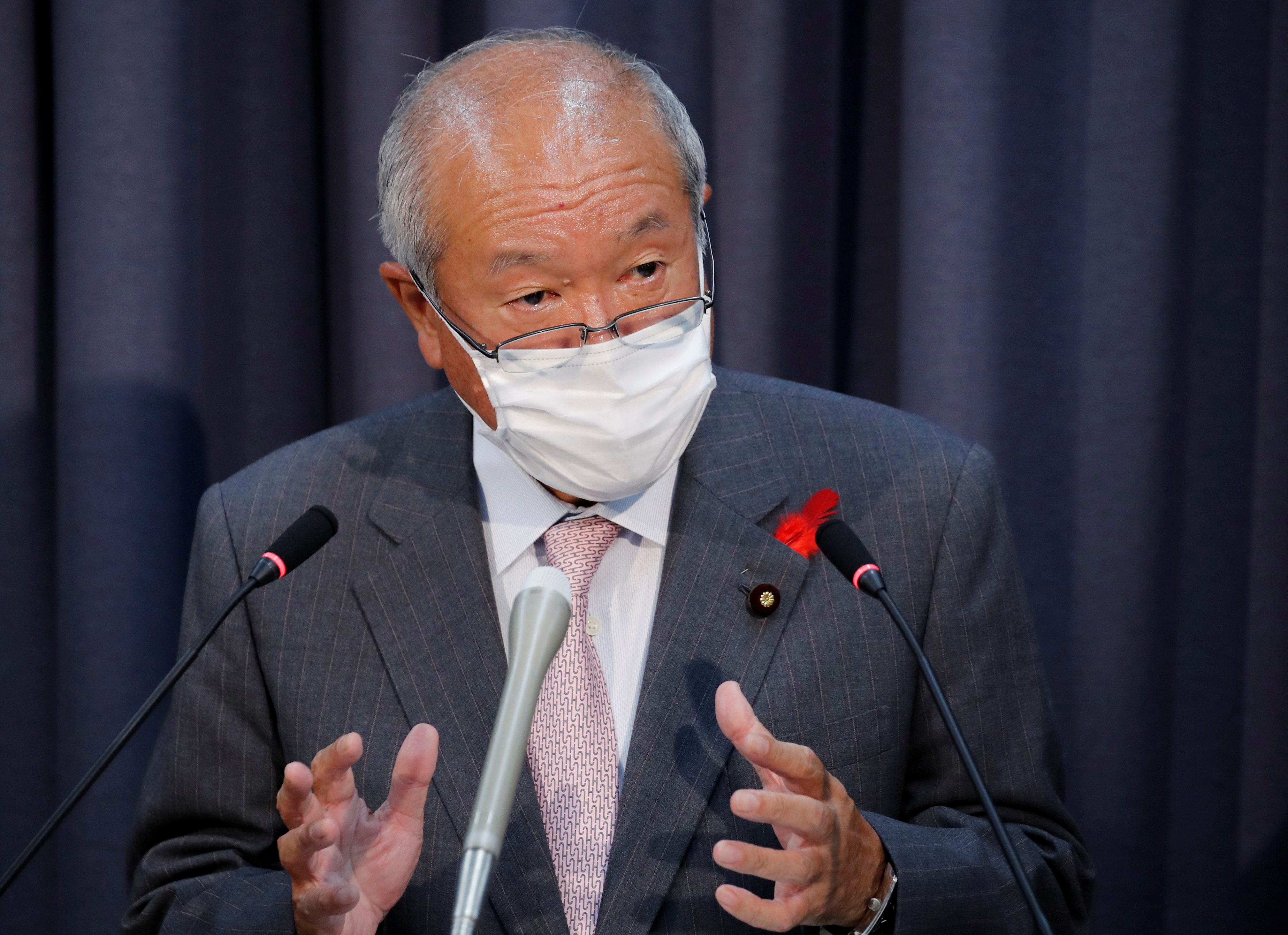

Japan Repeats Warning On Sliding Yen Keeps Mum On Fx Intervention Chance Reuters

Japan Repeats Warning On Sliding Yen Keeps Mum On Fx Intervention Chance Reuters

First Case Of New Covid Variant Found In France As Cases Rise Reuters

/cloudfront-us-east-2.images.arcpublishing.com/reuters/3TWYAUF6EVMILJGOUWQWVJOKTA.jpg)

Lockheed Martin Looks To Nearly Double Javelin Missile Production Reuters

Daily Devotional Devotions Math Equations

As A Professor I Sometimes Teach Freshmen This Was A Sobering Realization Nursing Memes Nurse Humor Teacher Humor

How Waffle House Is Used By Fema To Assess Damage Waffle House Hurricane Prep Hurricane Preparation

To Deviate From The Protocols We Will Have To Study The Traditions Primarily Needless To Say We Make An Effort To Make In Building Eco House Zero Energy House

Alabama Sales Use Tax Guide Avalara

Woolworth Register Receipt From 9 28 1996 Store 2280 Blue Ridge Mall Kansas City Mo Kansas City Blue Ridge Kansas